Scams to Avoid When Buying a Used Car

Buying a car should feel exciting—not stressful. Unfortunately, some used car shoppers run into dealers (or “dealers” posing as private sellers) who use pressure tactics and outright scams to push a bad deal through.

Below are common tricks to watch for, how they work, and what to do instead so you can slow the process down, verify the details, and walk away before you get burned.

Multiple Buyers Bluff

How it works: Once the salesperson notices you’re interested, they claim “other buyers are coming back today” or “someone else is already looking at it,” hoping you’ll purchase immediately.

Why it’s risky: Pressure is often used to prevent you from doing basic checks—like a proper inspection, test drive, or verifying history.

How to protect yourself:

- Keep your pace. If the car is truly right, it should still be right after you verify it.

- Ask for time to inspect and review paperwork.

- If you feel rushed or manipulated, treat it as a red flag and be ready to walk.

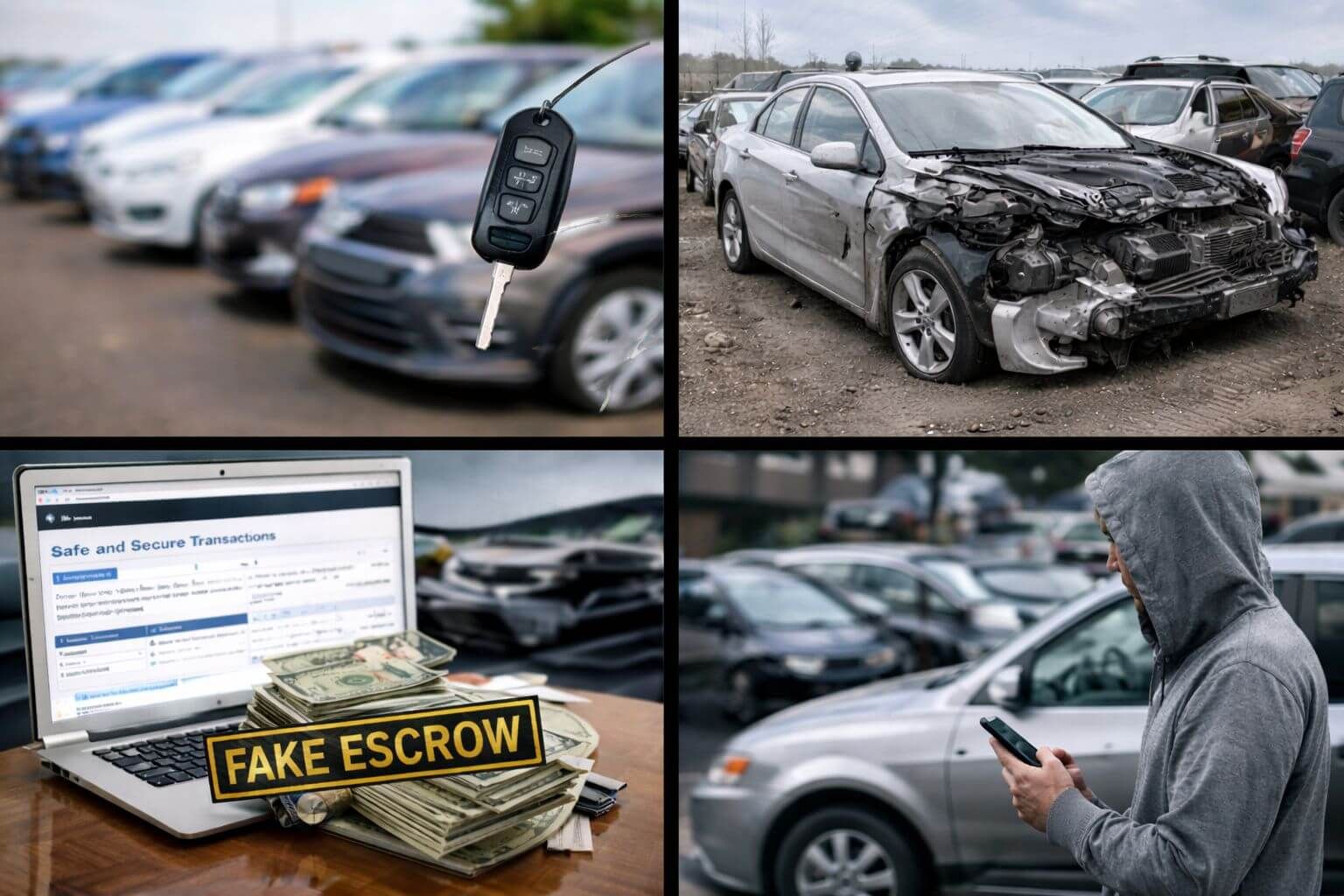

Title Washing

How it works: A vehicle that has been branded (for example, salvage/total loss) gets moved across jurisdictions to try to “clean” the title. If a new title is issued without the brand (or the brand is shown differently), the seller can market the vehicle as if it has a clean history.

Why it’s risky: Branded vehicles typically have lower market value and can hide serious past damage. If the branding is obscured, you may overpay and inherit long-term safety or reliability problems.

How to protect yourself:

- Get the VIN and verify the vehicle’s history before committing.

- Compare what the seller says with what a vehicle history report shows (title/branding, loss records, and prior registrations).

- If the seller won’t provide the VIN, that’s a deal-breaker.

For a quick check, you can run a vehicle history report through https://www.vinaudit.com/.

Fake Escrow Service Scam

How it works: This scam targets online buyers. The listing often uses stolen photos and a price that’s noticeably lower than comparable vehicles. The “seller” claims they’re overseas and insists on using a specific “escrow service.”

You’ll receive a convincing email instructing you to wire money (often via cash wiring services). Once payment is sent, the seller disappears.

How to protect yourself:

- Be skeptical of prices that are far below market.

- Avoid sellers who refuse an in-person meeting and inspection.

- Never wire money to strangers for a vehicle you haven’t seen.

- Prefer established marketplaces and sellers with verifiable history and feedback.

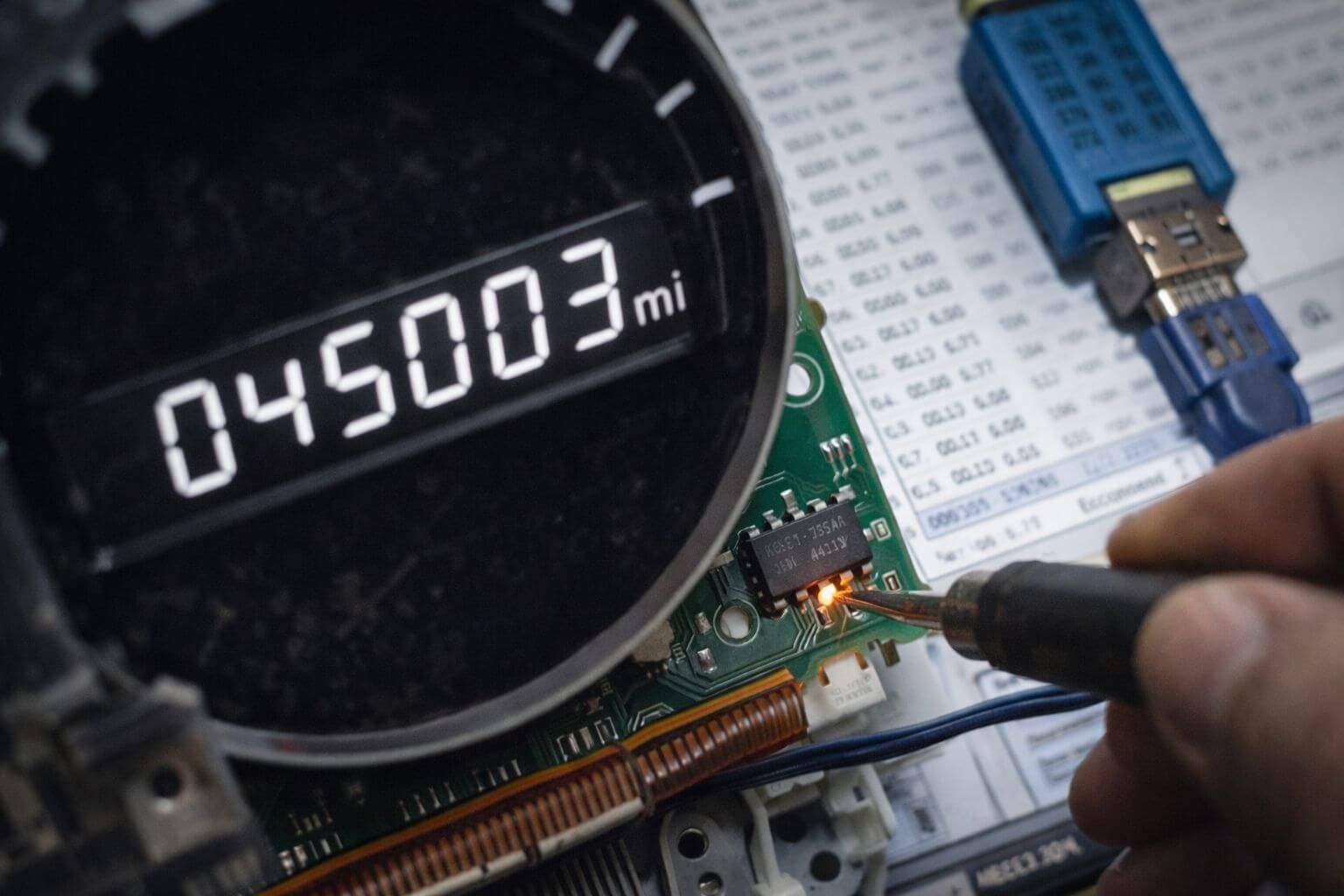

Curbstoners

How it works: Curbstoners regularly buy and sell vehicles without a dealer license or legitimate business location. They often pose as private sellers to avoid requirements and increase buyer trust.

Common risks:

- Odometer tampering

- Undisclosed frame or structural damage

- Salvage/rebuilt vehicles presented as “clean”

- Faulty safety devices

- Hidden liens or other claims

What to watch for:

- The title is left blank or “open” (seller’s name not on it).

- The same phone number appears across many “private sale” listings.

- The seller pushes for cash only and refuses traceable payment methods.

How to protect yourself:

- Make sure the name on the title matches the seller’s ID.

- Avoid transactions with incomplete or suspicious paperwork.

- If anything feels off, walk away.

Yo-Yo Financing

How it works: The dealer lets you drive away before financing is truly finalized. Later, they call saying the lender “didn’t approve” the original terms—then pressure you to accept a higher rate, higher price, or longer term.

How to protect yourself:

- Do not take the vehicle home until financing is fully approved and signed.

- Ask for written confirmation from the lender (not just the dealer).

- Review the final contract carefully and keep copies of everything.

Final Reminder

These tactics rely on one thing: rushing you before you can verify the car and the paperwork. If the deal starts to feel like a pressure cooker, slow it down. If they won’t let you, that’s your cue to leave and find a cleaner, safer deal elsewhere.