What Happens If You Buy a Car with a Lien in Canada?

What Happens If You Buy a Car with a Lien in Canada?

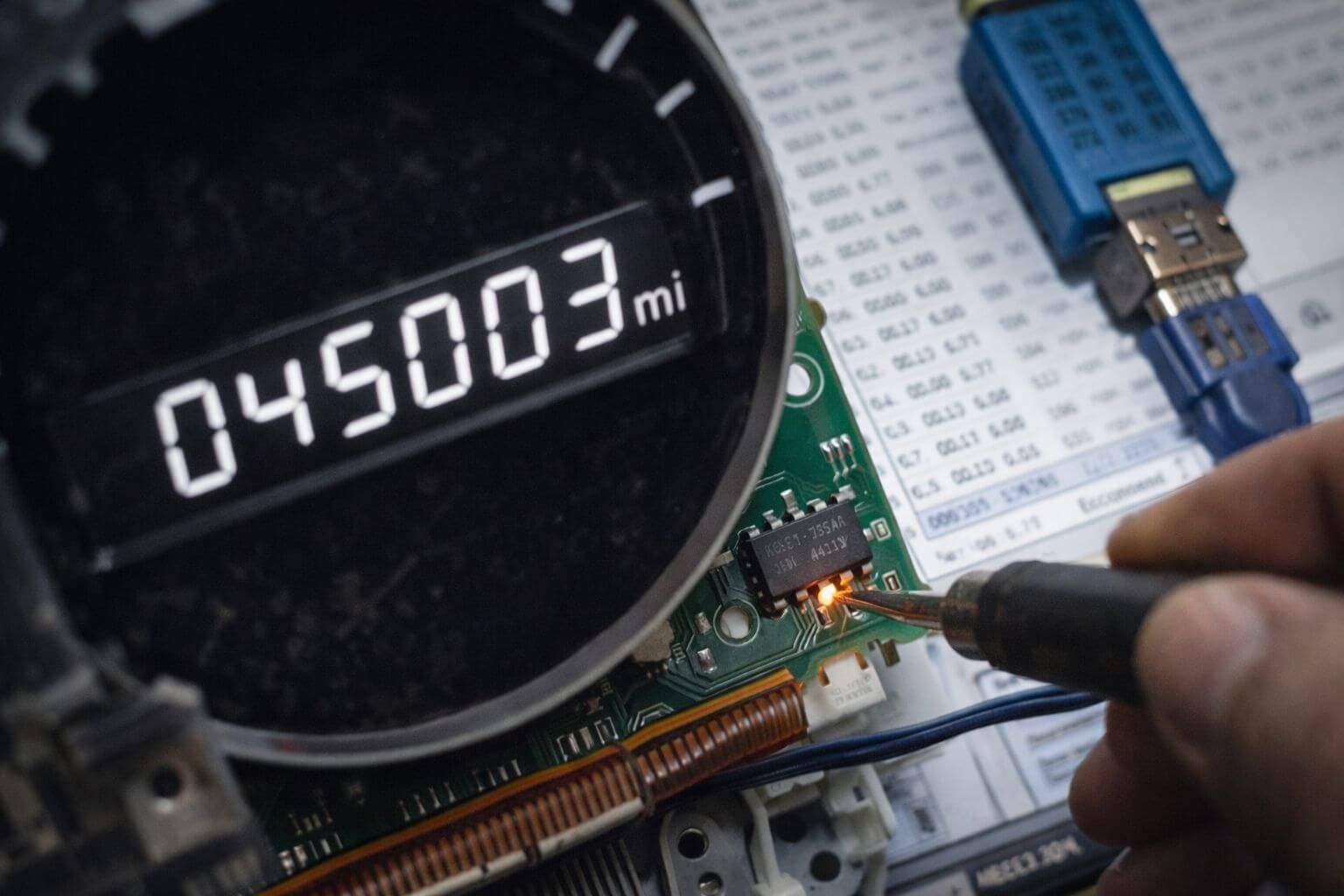

Buying a used car can save money and time, but discovering after the fact that the vehicle has an outstanding lien can turn a great deal into a legal and financial headache. This guide explains what a lien is, the legal consequences of buying a car with one in Canada, practical recovery options, and the steps to prevent it from happening in the first place.

Note: This article is for information only and is not legal advice. Laws vary by province and territory. Consult a lawyer for guidance on your situation.

What Is a Lien and Why It Matters

A lien is a lender’s legal claim against a vehicle as collateral for a debt. If the borrower defaults, the secured creditor can enforce its rights, which may include repossessing the car. In Canada, liens on vehicles are usually registered in provincial or territorial registries so creditors can publicly announce their interest.

Key points:

- Liens follow the vehicle, not the person, in most private sales.

- Buying from a licensed dealer often gives buyers more protection, especially if you are a buyer in the ordinary course of business.

- Private sales require extra diligence, because the lien generally continues against the car even after it changes hands.

How Liens Are Registered and Found in Canada

Most provinces and territories use a Personal Property Security Act (PPSA) registry or Personal Property Registry (PPR). Quebec uses the RDPRM under the Civil Code. Creditors file against the vehicle’s VIN and sometimes the owner’s name.

How to search:

- Perform a PPSA or PPR search by VIN in your province or where the seller resides, and in the province where the vehicle was previously registered.

- In Quebec, search the RDPRM.

- Cross-check with a vehicle history report from a reputable provider; it is a useful supplemental tool but not a substitute for a registry search.

- In Ontario, the Used Vehicle Information Package includes lien information; treat it as one source, not the only one.

Legal Consequences of Buying a Car with a Lien

If you buy a car that has an outstanding lien, these consequences are possible:

- Repossession risk: If the secured debt goes unpaid, the creditor may seize the vehicle, even from the new owner, because the security interest generally continues in the car after a private sale.

- Demand for payment: To keep the car, you may need to pay out the lien or come to an agreement with the lender. Interest and fees may continue to accrue.

- Limited defences: In many provinces, a buyer who purchased privately takes the car subject to the security interest. Buyers from licensed dealers may have stronger protections.

- Registration and resale complications: You may be able to register and insure the car, but the lien clouds title and complicates selling or financing the vehicle later.

- Potential legal action: If the seller misrepresented the status of the car, you can pursue civil remedies. However, this does not prevent the lender from enforcing its rights.

Recovery Options If You Already Bought the Car

If you discover a lien after purchase, act quickly and document everything.

- Confirm the lien details

- Run a fresh PPSA or RDPRM search by VIN. Save the report.

- Ask the lender for a payoff letter showing the exact amount and validity period.

- Contact the seller in writing

- Demand immediate payoff and a signed lien release, or rescind the sale and request a full refund.

- Set a clear deadline; keep all messages and receipts.

- Negotiate with the lender

- Propose paying the lender directly in exchange for a discharge. Obtain written confirmation that payment will release the lien and request a copy of the discharge once filed.

- If taking over the loan, ensure the lender formally approves the assumption; get updated loan documents and confirm the lien remains with you only upon assumption.

- Seek legal and regulatory help

- Small claims court: You can sue the seller for the purchase price, repairs, costs, and damages due to misrepresentation or breach of contract.

- Report suspected fraud to police and consumer protection authorities. In some provinces there are motor vehicle sales regulators for dealer transactions.

- If you paid with a credit card or a platform that offers buyer protection, explore chargeback or dispute options. Bank drafts and e‑Transfers have limited recourse.

- Protect your position

- Avoid putting more money into upgrades or repairs until resolved.

- Keep the car safe and insured. Do not conceal it from the lender, which may worsen your position.

Provincial Nuances to Know

- PPSA provinces and territories: Most use a PPSA or PPR system where security interests are registered by VIN. A buyer from a licensed dealer is often protected as a buyer in the ordinary course of business.

- Quebec: Liens are registered in the RDPRM. Civil law terminology differs, but the effect is similar: a secured creditor’s rights can continue into the vehicle after a private sale unless an exception applies.

- Cross‑province moves: If a car has been registered or sold in multiple provinces, run searches where the car and seller have ties.

Prevention Steps Before You Buy

Use this checklist to reduce lien risk:

- Run an official registry search: PPSA or PPR by VIN; RDPRM in Quebec. Do not rely solely on a commercial history report.

- Verify identity and ownership: Compare the seller’s ID to the registration and bill of sale. Ensure the VIN on the dash, door jamb, and documents match.

- Ask for a lien payout letter: If the seller still has a loan, meet at the lender’s branch to pay off the balance. Pay the lender directly and obtain a lien release receipt.

- Put it in writing: Your bill of sale should include a term where the seller warrants the vehicle is free of liens and agrees to indemnify you for any claims.

- Use secure payment: Avoid large cash deals. Consider escrow or a bank draft issued to the lender for the payoff amount and a separate draft to the seller for the remainder.

- Prefer licensed dealers: They typically handle lien discharges and are subject to consumer protection rules.

- Keep records: Save ads, messages, inspection reports, payoff letters, and copies of IDs.

What To Do Immediately If You Discover a Lien

- Day 1: Confirm the lien via registry search; contact the lender for payoff details; notify the seller in writing.

- Day 2 to 5: Propose solutions in writing: seller pays and provides discharge, or you pay lender directly and deduct from any remaining amount owed to the seller, or rescind the deal.

- Within 2 weeks: If unresolved, file a small claims action, report suspected fraud, and consider a lawyer’s letter to the seller. Keep following up with the lender to ensure a discharge is filed if paid.

Common Myths and Mistakes

- Myth: Insurance proves there is no lien. Reality: Insurance and liens are unrelated.

- Myth: A clean vehicle history report guarantees no lien. Reality: Official registry searches are the gold standard.

- Mistake: Paying the seller instead of the lender when a lien exists. Always pay the lender directly and get a release.

- Mistake: Skipping cross‑province searches. Prior registrations can reveal liens filed elsewhere.

Quick FAQ

- Can the lender take my car if I did not borrow the money? Yes, in a private sale the lien generally continues against the vehicle and can be enforced by the secured creditor.

- If I buy from a licensed dealer, am I safe? Often safer. Buyers in the ordinary course usually take free of certain security interests, but verify the dealer’s licence and documentation.

- How long does a lien discharge take? A lender can issue a release immediately upon payoff, but filing in the registry may take days. Ask for written proof of discharge.

- Do I need a lawyer? For contested or high‑value disputes, legal advice is wise. For smaller amounts, small claims court may be a practical route.

Bottom Line

A hidden lien can lead to repossession, added costs, and legal disputes. The best protection is prevention: run official registry searches, verify documents, and pay lenders directly when a payoff is needed. If you already own a lien‑encumbered car, act immediately, document everything, and use the recovery options above to protect your investment.